Arizona Income Tax Rate 2025 Calculator - Teacher strike Republican lawmakers raise taxes on middleclass and, This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025. Updated on apr 24 2025. Arizona Tax Calculator 2025 2025, This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025. Investomatica’s arizona paycheck calculator shows your take home pay after federal, state and local income tax.

Teacher strike Republican lawmakers raise taxes on middleclass and, This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025. Updated on apr 24 2025.

Tax rates for the 2025 year of assessment Just One Lap, It is calculated by dividing the total tax. Single married, filing separately head of household married, filing separately:

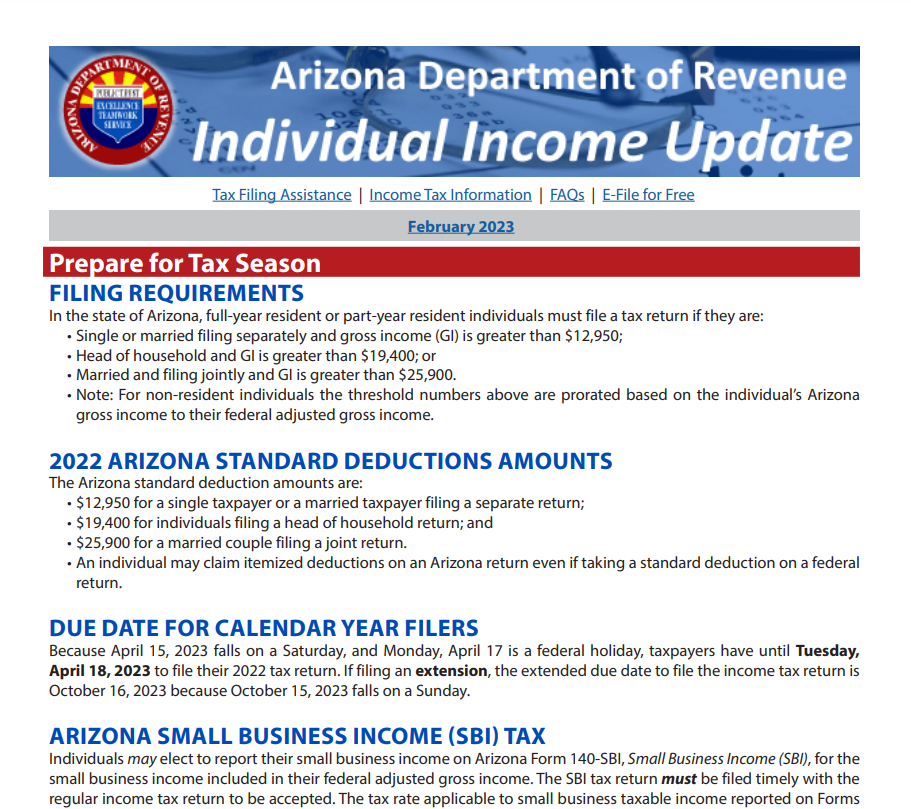

Federal Pay Raise 2025 Calculator Esta Olenka, The effective tax rate represents the average rate at which your income is taxed, providing a broad view of your overall tax burden. If you choose not to itemize on your arizona tax return, you can claim the arizona standard deduction, which is $13,850 for single filers and $27,700 for joint filers.

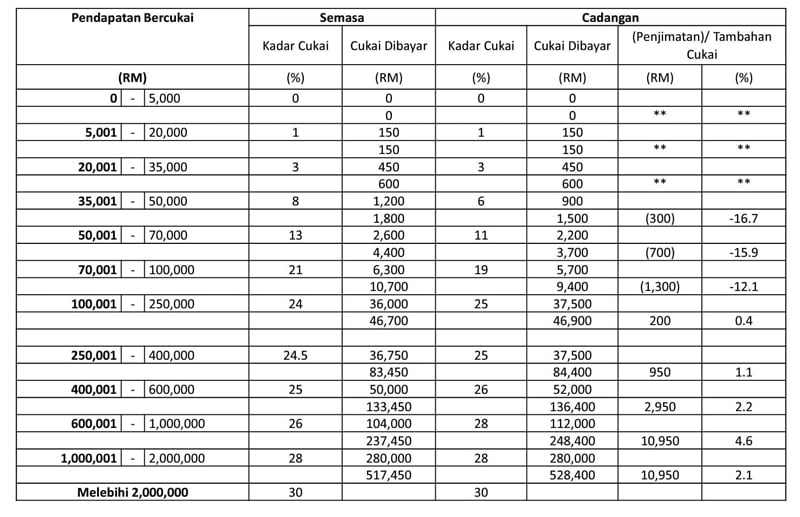

Tax savings for those earning below RM20,000 a month FMT, The arizona tax calculator includes tax. Estimate your tax liability based on your income, location and other conditions.

Updated for 2025 with income tax and social security deductables. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in arizona.

Single married, filing separately head of household married, filing separately:

Arizona Form A4 Effective January 31, 2025 Wallace, Plese + Dreher, This tool is designed for simplicity and ease of use, focusing solely on income. The effective tax rate represents the average rate at which your income is taxed, providing a broad view of your overall tax burden.

2025 State Tax Rates and Brackets Tax Foundation, The due dates for your state income tax return. Single married, filing separately head of household married, filing separately:

Everything You Need to Know About Arizona Tax Rebate 2025, There are three types of residency statuses in. Deduct the amount of tax paid from the tax calculation to provide an example.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10779931/Arizona_revenue_dollars_tax_cuts.png)

Arizona Income Tax Rate 2025 Calculator. Deduct the amount of tax paid from the tax calculation to provide an example. This rate applies to taxable income earned in 2025, which is reported on state tax returns filed in 2025.

Fed Tax 2025 Lynde Ronnica, The salary tax calculator for arizona income tax calculations. These numbers are subject to change if new arizona tax tables are released.

This tool is designed for simplicity and ease of use, focusing solely on income.

Alaska’s Property Taxes, Ranked Alaska Policy Forum, It is calculated by dividing the total tax. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in arizona.

The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in arizona.